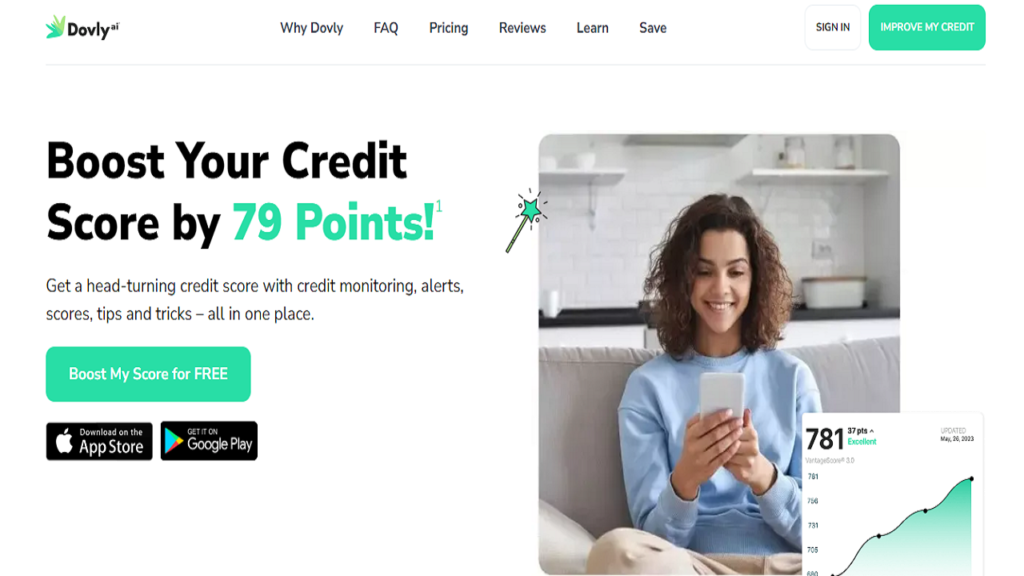

Until they are denied a credit card or loan, millions of Americans are unaware knowing they have inaccuracies on their credit record. Allow us to introduce you to Dovly AI, an AI credit engine which can assist you with credit monitoring, AI credit repair, (re)building, and protection.

Dovly employs in-house artificial intelligence to detect issues and provide a personalized approach to eliminate negative inaccuracies from your credit report.

To avoid AI detection, use Undetectable AI. It can do it in a single click.

How Dovly AI Functions?

Dovly AI sets itself apart with its comprehensive approach to credit management. Dovly AI dedicated to treating and resolving your credit concerns. Dovly do not just assign you a score or problem.

With just one simple to operate interface, Dovly AI delivers a comprehensive credit care platform which gives you the tools you need to manage your credit and enhance your financial health. Your one-stop credit management solution is Dovly AI; wave goodbye to juggling different solutions.

Link Up Your Credit Record

Without ever generating an exhaustive search, Dovly AI imports and evaluates your credit record from three bureaus, looks for unfavorable accounts, and creates a thoughtful and aggressive dispute plan.

You can remove these accounts from Experian, Equifax, and TransUnion with the use of Dovly AI:

- Bankruptcy

- Inquiries

- Judgements

- Foreclosures

- Collections

- Charge offs

- Repossessions

- Late payments

It is not required to register with each credit bureau. You can use three bureaus with Dovly AI.

Contest Each Account of These Three Bureaus

With the assistance of Dovly AI, you can raise strong disputes towards accounts which harm your credit removed. Hiring a credit repair company to submit boilerplate challenges which the three bureaus can lawfully reject is a waste of time and money.

Compared with competing credit repair companies, Dovly assist you in filing productive disputes. The agencies would not reject them because you sent them yourself. Dovly AI allows you simple to file disputes with three bureaus and raise your credit score.

Receive Countless Disputes Which Indeed Work

You can dispute multiple accounts on three bureaus at once as you had like. Dovly AI can handle and track number of accounts, regardless of the number of you have to dispute.

Dovly AI is aware of various bad accounts call for various approaches to dispute them. Contesting a collection account, for instance, is not the same as contesting a bankruptcy. We assist you in formulating the appropriate dispute to secure a permanent removal.

Monitor Your Outcomes

Your disputes are tracked using Dovly AI throughout three bureaus. Dovly import your updated credit report each month, displaying your updated credit score as well as the accounts which have been closed. If an account was not removed, Dovly AI will suggest a different approach for future conflicts.

Dovly promise to keep you informed regardless of times; with Dovly, you will always be aware of the status of your credit score and repair.

Why to Use AI to Boost Your Credit Score?

It is complex to repair your own negative credit. To get dubious negative information deleted from your credit reports, get in touch with the credit bureaus and your creditors. Dovly AI offers free, customized advice on how to raise and maintain your credit score.

With Dovly AI credit engine, Dovly AI expedites the dispute procedure and produces quicker outcomes. Companies offering credit restoration services can seem ineffectual if they submit your complaints in one go using generic letters which tend to be turned down the three credit bureaus.

Sending three disagreements at once is suitable, as determined through Dovly AI’s scientific approach to AI engine development. In addition to helping feed the algorithm in order rounds will be effective, this lessens the likelihood of credit bureaus would flag your account as frivolous.

Handle Conflict Properly

Dovly’s AI engine is equipped with a trade secret for online filing disputes to major credit bureaus. When it comes to negative credit restoration, AI systems can perform quicker than people. This speed matters for credit improvement because prompt dispute and correction handling can raise or lower a person’s credit score.

AI is capable of spotting possible errors in credit reports and producing dispute letters to correct them. Through streamlining the dispute resolution procedure, this enables people to contest and update false information on their credit reports.

Never Spend Too Much to Build Credit Again

When opposed to employing a credit repair business, the effectiveness and automation which AI provides can result in financial savings. Credit repair services may be affordable because credit issues are resolved quicker and there is less manual labor involved.

Automate Processes

Numerous steps in the credit enhancement process can be automated using AI, which increases process effectiveness. Dovly AI system can perform tasks such as evaluating credit records and locating errors, inconsistencies, and negative elements which can be influencing a person’s credit score.

This automation allows you to improve your score quicker through expediting the initial assessment phase.

Quicker Access to Additional Data

Artificial Intelligence is effective at handling and interpreting large volumes of data, such as credit reports, transaction histories, and other financial data. In order to help discover areas which need attention, AI algorithms are able to recognize patterns, trends, and anomalies in this data.

Predictive analytics is another tool AI can use to foresee future trends or credit problems. Artificial intelligence can assist people in choosing wise financial decisions which avert future credit issues through spotting patterns in their financial behavior.

Stay Updated on Developments in the Lending Industry

Navigating through a complicated web of rules and legislation is required for credit repair. Legal problems can be minimized through programming AI systems to guarantee adherence to certain rules.

AI systems are able to learn from and adjust to modifications in credit reporting laws, policies, and algorithms. Being adaptable implies so the credit repair procedure stays current with market standards and efficient.

Conclusion: AI Credit Repair

While AI Credit Repair is not a miracle cure, Dovly AI is a potent tool in your toolbox for dealing with credit issues. You can get an improved financial future and raise your credit score through the use of AI’s automation and analytical skills.

Do your homework, check into reliable AI credit repair companies, and become in charge of your financial future. The process of redeeming your credit score might go quicker and smooth when AI is on your side.

FAQs: AI Credit Repair

What is AI Credit Repair?

AI Credit Repair is a modern approach to improving your credit score using artificial intelligence technology. It involves the use of algorithms and data analysis to identify and address any issues on your credit report which may be impacting your credit.

How does AI Credit Repair work?

AI Credit Repair works through analyzing your credit report and identifying areas which need improvement. Using advanced algorithms, an AI engine can generate personalized credit repair solutions to help boost your credit score and achieve better credit health.

What are the benefits of AI Credit Repair?

AI credit repair offers effective disputes than traditional methods. By using artificial intelligence, you can receive personalized credit solutions tailored to your specific credit issues, helping you improve your credit score and achieve financial freedom.

Can AI Credit Repair help in disputing errors on credit report?

Yes, AI Credit Repair can assist you in disputing inaccuracies on your credit report. The use of AI-powered credit repair software can process efficient and increase the chances of errors being deleted and your new credit information being updated with the 3 bureaus.

Is it worth hiring a Credit Repair Company that uses AI technology?

Hiring a credit repair company which uses AI technology can be beneficial, as it can offer advanced credit repair solutions and dispute letters to address your credit health. Such companies can help you protect your credit while working to improve your credit score.