Artificial intelligence (AI) and machine learning are revolutionizing the world of stock trading. AI-powered bots can analyze huge amounts of data, identify patterns and opportunities, and execute trades faster and more accurately than humans ever could.

In this post, we’ll explore the 10 best AI stock trading bots available in 2024 for retail stock traders and individual investors. These bots have been tested and proven to generate significant returns consistently.

Whether you’re an active day trader or a long-term investor, these bots will enhance your performance and give you an edge over old-school manual trading. Let’s discuss the AI Stock trading bots in detail.

“If You want to Remove AI Detection and Bypass AI Detectors Use Undetectable AI: It can do it in one click“

1. Trade Ideas

Trade Ideas tops our list as the best AI stock trading bot overall. Their proprietary AI algorithms constantly scan the markets for the most profitable day trading opportunities.

Trade Ideas offers three main trading bots:

- Holly AI – Analyzes all US stocks and identifies the best day trade setups with a 60%+ historical win rate and 2:1 reward/risk ratio.

- Holly 2.0 – A more aggressive version of Holly that provides day trading signals with a historical return of 33% annually.

- Holly Neo – Seeks short-term price pattern breakouts, both long and short. Great for active day traders.

A key benefit of Trade Ideas is that it shows clear buy and sell signals right on the chart, so you know exactly when to enter and exit trades.

You can even automate your trading by connecting Trade Ideas to your brokerage account. The AI bots can place trades automatically within seconds of a signal being triggered.

Historical performance audits show the Trade Ideas AI bots consistently beat the market. For example, $50k invested with the Holly Grail bot returned 42% over 2 years compared to just 32% for the S&P 500.

For active day traders seeking consistent profits, Trade Ideas is hands-down the best AI trading bot available.

2. TrendSpider

TrendSpider provides cutting-edge AI tools for technical analysis and backtesting trading strategies. Their automated chart pattern recognition and trendline drawing save traders hours of manual work.

Key features include:

- Automatic identification of chart patterns, candlesticks, and support/resistance levels.

- Backtesting engine to refine strategies with just a few clicks.

- Trading bot integration via webhooks. TrendSpider alerts can trigger automated order execution.

- Scanning for trade setups across thousands of stocks and ETFs.

- Sophisticated indicators such as volume profile, VWAP, custom moving averages, and more.

TrendSpider shines for active traders who rely on technical analysis. AI pattern recognition provides an edge in finding high-probability chart setups. The backtester helps build consistently profitable strategies.

For automated trade execution, TrendSpider integrates seamlessly with SignalStack (covered below).

Overall, TrendSpider stands out as the most advanced AI technical analysis and backtesting platform available today.

3. Tickeron

Tickeron offers AI-powered investment strategies and trading bots for short-term traders. The platform was developed by a team of data scientists and engineers from SAS, a leader in analytics.

Some key features:

- AI Trading Bots – Choose from over 30 pre-built bots specializing in stocks, ETFs, forex, and crypto. The bots scan the markets 24/7 and identify trading opportunities.

- Audited Performance History – Every Tickeron bot has an audited track record showing percent profitable trades, ROI, risk metrics, and full trade details. Transparency is crucial.

- AI Trading Portfolios – Select pre-built portfolios structured by the AI to maximize performance and manage risk. For example, asset allocation bots specializing in dividend stocks, biotech, crypto, and more.

- Pattern Recognition – Automatically identify chart patterns, candlesticks, and indicators that historically precede big price movements.

Tickeron stands out for its rigorous auditing of each trading bot’s historical performance. This level of transparency is unmatched. For traders seeking short-term profits with quantified strategies, Tickeron hits the mark.

4. MetaStock

MetaStock offers robust tools for backtesting, forecasting, scanning, and building trading systems. Their platform includes over 700 technical indicators plus an AI pattern recognizer.

While not a fully automated trading bot, MetaStock does provide an expert advisor feature with pre-built algos. With some coding knowledge, traders can modify the advisors or build new strategies from scratch.

MetaStock connects to dozens of global exchanges in stocks, forex, futures, and other asset classes. Real-time news from Dow Jones and proprietary forecasting tools like the NeuroShell Predictor complement the platform.

For quants and coders seeking a customizable trading bot and backtesting solution, MetaStock delivers. Their eco-system of add-ons and availability in over 90 countries makes them a leader in technical analysis software.

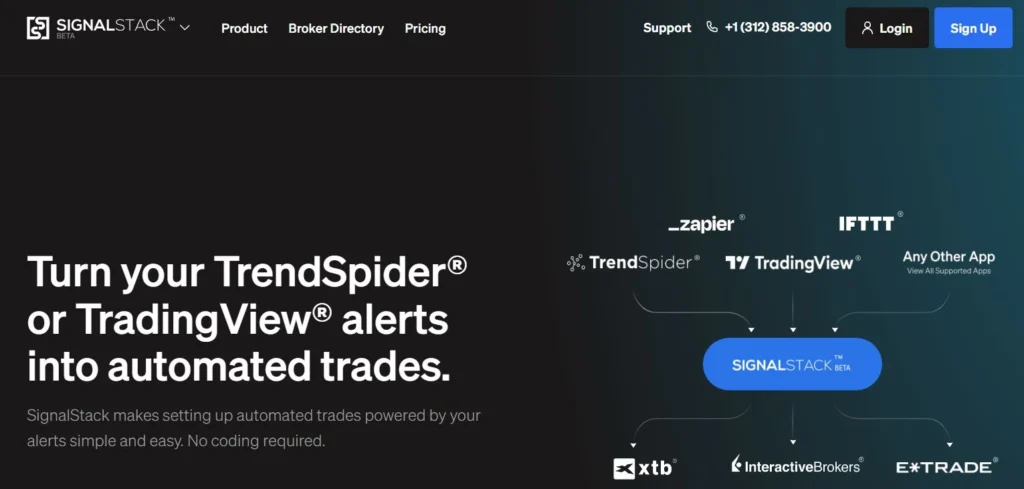

5. SignalStack

Unlike the other platforms covered so far, SignalStack focuses entirely on automated order execution. It’s a middleware tool that connects your AI signals to your brokerage account.

The workflow is simple:

- Use trading software like Trade Ideas or TrendSpider to identify opportunities

- Configure alerts when your buy/sell criteria are met

- Connect your brokerage account to SignalStack

- SignalStack automatically executes orders as soon as an alert is triggered

With SignalStack, your trades can be placed in seconds rather than minutes. This speed helps reduce slippage and maximize profits.

You keep full control over trade sizing, limits, etc. SignalStack just provides the automated pipeline from signal to trade execution.

For active traders seeking split-second order execution, SignalStack is a must-have. It complements AI analytics platforms perfectly.

6. TradingView

TradingView is a leading social network and charting platform for traders with over 30 million monthly users. Their online charting tool includes hundreds of technical indicators plus AI pattern recognition for candlesticks and chart patterns.

TradingView allows traders to share charts, strategies, and live trade ideas publicly or privately with chat groups. The crowd-sourced trading intelligence provides valuable insights.

For automated trading, TradingView enables traders to configure alerts based on indicator or pattern triggers. You can integrate TradingView alerts with SignalStack for auto-execution with your brokerage.

With its massive global community and excellent charts, TradingView is a top choice for both manual and automated AI trading.

7. VectorVest

VectorVest takes a simplified approach to AI stock analysis. Their system uses five core metrics to identify stocks with strong fundamentals that are moving into uptrends:

- Value – How undervalued is the stock relative to peers?

- Safety – Does the company have strong financials?

- Timing – What is the technical trend?

- VST – An aggregate of the first three metrics

- Market Timing – Is the overall market supportive?

VectorVest scans the entire market daily and assigns a numerical value to each metric. Stocks ranking highly across all metrics make the best trades.

The system is easy to use for beginners but lacks transparency on how the metrics are calculated. There is no documented trading performance.

For simple AI stock filtering based on fundamentals and timing, VectorVest is a decent choice. But more advanced traders would benefit from platforms like Trade Ideas and TrendSpider.

8. QuantConnect

QuantConnect offers a lean open-source algorithmic trading platform aimed at quants and developers. You can code trading strategies and bots in Python, C#, F#, and other languages.

The platform includes 500+ data sources, a back tester to refine strategies, and brokerage integration to go live. Community-shared algorithms provide a jump start.

While coding is required, QuantConnect does minimize the infrastructure work needed to run algorithmic trading systems. It’s ideal for programmers seeking a customizable, open-source trading bot framework.

9. Numerai

Numerai takes a uniquely collaborative approach to building AI models. The company provides an anonymized dataset of financial data and hosts modeling competitions for data scientists. Winners are paid in the platform’s Erasure (ERA) cryptocurrency.

The top-performing models are combined into a “Meta Model” which trades the live markets. As profits are made, data scientists who contributed are compensated.

For machine learning experts, Numerai provides a rewarding avenue to put skills into practice in financial markets. It’s more of a collaborative science project than a self-directed trading bot, but rewards can be significant for top quant talent.

10. Sensibull

Sensible is an AI platform focused exclusively on options trading in India. The bot provides alerts for opportunities in stocks, indices, currency, commodity, and crypto options.

The algorithm uses a mix of statistical, fundamental, and technical analysis to identify high-probability options trades. It evaluates Greeks, implied volatility, and sentiment to recommend entries, exits, and hedges.

Sensibull connects directly to brokerages such as Zerodha to automate order execution upon alert. Performance analytics helps traders refine strategies and manage risk.

For options traders in India seeking automated alerts and order execution, Sensibull is the leading choice. For other markets, options-focused bots have yet to emerge.

Honorable Mentions

There are a few other emerging platforms worth keeping an eye on:

- Stratifi – Offers managed AI portfolios aiming to outperform benchmarks through machine learning algorithms. Still early stage.

- Cap.Ai – Automated investing service that builds personalized portfolios optimized through AI and rebalancing.

- RoboMarkets – Brokerage that provides trading bots focused mainly on forex and crypto. More limited stock bots currently.

- QuantOdds – Supplying curated quantitative algorithms and proprietary data to hedge funds and family offices. Not retail focused yet.

Avoid These Unproven Trading Bots

While AI trading bots show much promise, some lack proof that they actually work reliably. Based on our research, here are a few trading bots to avoid:

- Algoriz – Makes big claims but provides no evidence of value. Company appears defunct. Could not even create an account to do testing.

- Kavout – Another AI stock analysis tool with big promises but no track record. Also appears to be a failed startup attempt. No way to try the software.

- StockHero – Claims an absurd 90% win rate with no audited results. Rejected attempts to create an account to analyze historical performance.

The bottom line is if a trading bot company does not provide transparent performance reports and evidence to back up claims, proceed with extreme caution. There are no shortcuts to consistently beating the market.

How to Choose the Best AI Trading Bot

Here are key factors to evaluate when choosing an AI or algorithmic trading solution:

- Audited Performance History – Critical to see unbiased reports on win rates, risk metrics, and detailed trading results. Lack of transparency is a red flag.

- Ease of Use – Will you need to code your own strategies or are pre-built bots available? Coding ability affects which solution works best.

- Trading Style Fit – Day trading requires different bots than long-term investing. Be sure the bots match your specific trading needs.

- Brokerage Integration – Seamless execution from bot signals to live trades is essential. Checking reviews for any issues is wise.

- Trustworthiness – Research the reputation of the company behind the bots. Long operating history and satisfied users build trust.

- Risk Controls – At minimum, bots should enable stop losses. Additional risk guards like position sizing are better.

- Cost – Evaluate if subscription fees align with your activity level and profit potential. Most offer free trials.

The Future of AI Trading Bots

AI and machine learning will increasingly dominate trading and investing as the technology improves. Here are a few predictions:

- More brokerages will offer built-in trading bots accessing their customer order flow and data feeds. Think “robo advisor” meets “algo trader”.

- Cryptocurrency exchanges already lead in providing embedded trading bots. Expect to see these capabilities migrate to stock brokerages next.

- Individual investors will gain access to institutional-quality analytics and automation that used to be available only to hedge funds.

- As machine learning models are trained on more data over time, predictive accuracy will improve allowing for new innovations in trading strategies.

- Alternate data sources such as satellite imagery, credit card transactions, and web scrapers will feed into AI models for enhanced insights.

Will Trading Bots Replace Humans?

In short, no. Bots do not (yet) match human judgment and adaptation skills. The best results come from combining human expertise with machine automation and data processing capabilities.

Rather than be replaced, traders may spend more time analyzing bot performance, seeking new data sources, and conceiving innovative trading hypotheses for bot implementation. Successful traders will need to master selecting, configuring, and managing AI systems.

Conclusion

AI trading bots are transforming markets by enabling more precise and fast execution. The top bots profiled here have demonstrated an ability to generate consistent profits and reduce risks by removing human errors and limitations.

For active traders and investors, integrating a proven AI or algorithmic trading system into your process could significantly improve returns. As with any tool, ensure you fully understand how the bots work before trusting them with real capital.

Human intelligence plus artificial intelligence yields the strongest trading performance. By combining them appropriately, traders can potentially reach new heights of success.

FAQ’s About AI Stock Trading Bots

What are the best AI stock trading bots?

The top AI trading bots are Trade Ideas, TrendSpider, Tickeron, MetaStock, and SignalStack based on audited performance, features, ease of use, and reliability.

How profitable are AI stock trading bots?

The top bots can generate 20-40% annual returns through algorithmic trading strategies, beating comparable passive index funds. Results vary based on market conditions and risk management.

Are AI stock trading bots worth it?

For active traders, proven AI bots like Trade Ideas can provide an edge over manual trading through automated pattern recognition and order execution. They are worth considering.

Can AI predict stock prices?

AI bots analyze historical data to identify patterns predictive of future price movements. The best systems generate buy/sell signals with roughly a 55-60% accuracy rate.

What are the risks of using AI stock trading bots?

Poorly designed bots carry risks like overtrading, excessive risk taking, and financial losses. Stick with established platforms with track records to mitigate these risks.

Do AI trading bots actually work?

Yes, the best AI trading bots have proven to generate consistent profits over time. For example, Trade Ideas’ bots produced over 20% annual returns over multiple years, beating comparable passive investments. However, not all trading bots work well, so it’s important to vet their track record.

Can I use AI to automate trading?

Yes, AI enables the automation of trading strategies and order execution. Leading platforms like Trade Ideas, TrendSpider, and Tickeron allow configuring trading rules and algorithms that can automatically scan markets, identify opportunities, and execute trades via brokerage integration. AI automation eliminates manual processes for much faster and efficient trading.