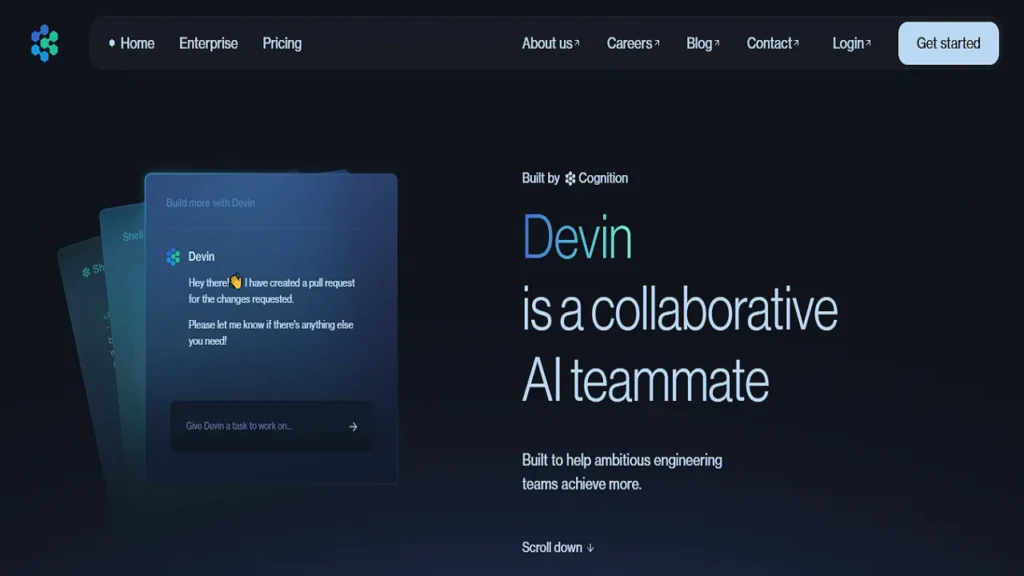

Setting a new benchmark for SWE-bench coding proficiency. Introducing Devin, the earliest entirely self-sufficient AI software engineer in history. Devin is a dedicated, capable team player who is equally willing to work with you to construct or finish projects on his own for you to assess.

Devin enables engineering teams to aim higher and engineers to concentrate on deeper issues. Devin AI stock presents an opportunity for those looking to invest in the future of technology.

With a focus on research and development, the company is not just keeping pace with industry advancements but also setting trends that could redefine market standards. Understanding the dynamics of Devin AI stock becomes necessary for investors aiming to capitalize on the next wave of technological transformation.

To avoid AI detection, use Undetectable AI. It can do it in a single click.

Table of Contents

Devin AI

Devin AI is an Ethereum blockchain DeFi token. Since introduction, Devin AI has had 2,913 transactions with 0 holders and a $7,977 liquidity pool. For 243 days, the token has existed.

Devin AI Trading Locations

Using any of suggested swaps, you can buy the token mentioned above. This cryptocurrency is traded on Uniswap V2 at the moment.

Devin AI Price

Devin AI’s lowest price for the past day was $0.00002170. Devin AI’s highest price over the past 24 hours was $0.00002170. With a 24-hour volume of zero, the price of Devin AI Token is currently $0.00002170. Devin AI has not increased in the past 24 hours. The market value of Devin AI is $21,703.

Devin AI Token Address

Devin AI’s token address is 0xf70dcf88b74786d25a15f4843d63254a8662ef46.

How to Buy Devin AI?

The CoinBrain Trade feature, which automatically determines the fastest and least expensive swap option for you, is the best way to buy Devin AI. In addition, you can purchase it on Uniswap V2, for instance.

Devin AI Liquidity Pool

The 1 Devin AI liquidity pool has $8,083.57 in it. That is roughly 33.89% of Devin AI’s current market capitalization.

Devin AI Holdings

Devin AI has 398 owners, 85 of them are large holders (wallets having over 855M DEVIN).

Devin’s Capabilities

Devin is able to plan and carry out intricate technical projects that involve thousands of decisions due to advancements in long-term thinking and planning. Devin is able to learn over time, correct errors, and remember the necessary context at each phase.

In a sandboxed computing environment, Cognition have also given Devin access to standard developer tools including a shell, code editor, and browser: everything a human would require to complete their tasks.

At last, Cognition have enabled Devin to actively work with the user. Devin collaborates with you on design decisions when necessary, accepts criticism effectively, and provides real-time progress reports. Devin is capable of the following:

- Devin is able to pick up new technology skills.

- Devin has complete app development and deployment skills.

- Devin is able to automatically identify and correct errors in codebases.

- Devin has the ability to develop and optimize its own AI models.

- Devin is able to fix issues and add features in open source projects.

- Devin has the ability to add to established production repositories.

- We even attempted to assign Devin actual jobs on Upwork, and it was able to do these in addition.

Devin’s Performance

Devin was assessed using SWE-bench, a demanding test that requires agents to fix actual GitHub problems in open source projects such as scikit-learn and Django. Devin significantly outperforms the previous state-of-the-art, which was 1.96%, by correctly resolving 13.86% of the issues end-to-end.

The finest models from the past can only fix 4.80% of problems, even if they provided the precise files to change. Devin was assessed using a 25% random subset of the data. While every other model received assistance that is, instructions on which files needed to be edited: Devin was left alone.

Devin’s Six-Month-Old AI Startup is Now Worth $2 Billion

Peter Thiel’s Founders Fund alone contributed $175 million to Cognition Labs, and the company intends to raise additional funds. Six months after its launch, Cognition Labs, the AI business that created popular software development platform Devin, has raised $175 million in venture capital funding, and its valuation has risen to $2 billion.

Founded in November of last year, Cognition gained widespread attention in March when it unveiled its AI-powered software development platform. The sole investor in the round was Founders Fund, a venture capital firm formed by Peter Thiel. In March, the company led Cognition’s series A fundraising round.

Cognition is just one of among several outstanding AI businesses. The Now-Google-owned DeepMind, ChatGPT manufacturer OpenAI, Elon Musk’s brain interface venture Neuralink, and data analytics company Palantir are just a few of the companies that the Founders Fund has supported.

In a statement on X (previously Twitter), Cognition acknowledged the funding and praised Founders Fund, prior investors, Khosla Ventures, and serial tech investor Elad Gil. However, the startup’s statement concludes with the words, now on to the next commit, indicating that it is focused on obtaining additional funding.

Can Cognition Reach New Heights?

When Devin initial revealed, he created a stir. Thirty million people viewed the announcement tweet alone. Some of the prominent individuals in AI took notice of Cognition in the weeks after its viral debut. The CEO of the company, Scott Wu, remarked, Wow, it is being quite the month.

OpenAI benefited the startup by granting early access to the new GPT-4 Turbo with Vision model, which can comprehend both text and images. The Devin platform from Cognition accomplishes its visual coding jobs with the help of the Vision model. But the startup has encountered difficulties.

various internet users also criticized its initial demo, pointing out various discrepancies with the claims made by Cognition about its capabilities. Last week, Wu addressed the worries on X, stating that Devin was far from perfect today. Wu remarked, Devin is often productive but often commit mistakes, write bugs, or get stuck.

We cannot wait for users to test the product so we can keep improving based on your input.

Nvidia’s Stock Rises Due to AI Development and Oracle Collaboration

Due to a potential relationship with Oracle and robust demand for cloud services centered on artificial intelligence, Nvidia’s stock (NVDA) surged 7.2% on Tuesday, continuing its winning streak. Strong quarterly performance and rising demand for AI cloud services were revealed by Oracle.

The business alluded to upcoming partnerships while highlighting a recent cloud infrastructure deal with Nvidia. With a 98% market share in data centers and a 95% market share in machine learning processors, Nvidia is primed for the AI boom due to their supremacy in GPU technology.

Nvidia has had record growth for three quarters in a row due to its dominance, and another record-breaking quarter is anticipated. Nvidia’s growth trajectory could leave its present price point justified despite its premium value.

Why It Is Necessary

- This report supports the idea that demand for generative AI is rising.

- Nvidia’s market dominance in AI-essential hardware puts it in a strategic position to take advantage of this demand.

- Nvidia’s position in the AI market is further strengthened by the Oracle alliance.

- Investors are placing bets on Nvidia’s sustained success as a major force in the rapidly expanding AI industry.

Conclusion: Devin AI Stock

Coding’s future is arrived, and it can write lines quickly than you can say caffeine break. The AI revolution is causing Nvidia’s stock to skyrocket, and one significant event is upending the status quo: Devin, the first AI code engineer, has arrived.

With its extensive cloud project training programs and cloud certifications, AI Hub provides you the tools you need to incorporate AI tools such as Devin into your workflow with ease.

FAQs: Devin AI Stock

What is Devin AI and how does it relate to the stock market?

Devin AI is a pioneering company in the AI sector that focuses on developing advanced AI software solutions. As a publicly traded entity, Devin AI stock represents ownership in the company and is influenced by various factors including its market cap, product innovations, and performance in the AI industry.

Investors often look at the company’s price chart to gauge its performance over time and make informed decisions.

What factors influence the Devin AI stock price?

The price of Devin AI stock is influenced by numerous factors including company earnings, product launches, trends in the AI industry, and overall market conditions. Key developments such as the introduction of new AI tools, successful trading strategies, or partnerships can prompt price movements.

Investor sentiment and news about the company or the broader tech industry can also impact its valuation.

How can I invest in Devin AI stock?

Investing in Devin AI stock can be done through various brokerage platforms. Interested investors should research the company’s financial health, market cap, and recent performance trends. After choosing a brokerage, you can purchase shares directly or consider investing in fund options that include Devin AI as part of their portfolio.

What is the Devin to USD price?

The Devin to USD price refers to the current exchange rate between Devin AI tokens and US dollars. This price can fluctuate based on market demand, investor behavior, and performance of the AI sector. Investors often track this price to assess their investment’s value.

What role does Scott Wu play in Devin AI?

Scott Wu is one of the key figures behind Devin AI, serving as a fundamental part of the leadership team. His role involves overseeing the development of innovative AI solutions and strategic decisions that shape the company’s trajectory in the AI market. His expertise is necessary in navigating the complexities of the tech industry.