How to buy Figure AI stock?

Purchasing Figure AI’s stock is difficult because it is a private firm. We can guide you through the process of buying shares, explain its valuation, and analyze its future.

To avoid AI detection, use Undetectable AI. It can do it in a single click.

Figure AI

Brett Adcock founded Figure AI with the goal of automating manual labor. The company’s humanoid robots support the worldwide supply chain, address manpower shortages, and do unwanted or dangerous duties.

Adcock boldly intended to create a walking bipedal robot within a year of the company’s 2022 launch, with an initial expenditure of $100 million. Investors and the tech sector took notice of this notion. The humanoid robot, Figure 01, is the focal point of Figure AI’s innovation.

It has advanced characteristics such intelligent embodied agents, humanoid technology, and the ability to manufacture in large quantities. In the developing field of AI robotics, these robots stand out because they can think, learn, and interact safely. Strategic alliances are a major factor in Figure AI’s success.

By collaborating with OpenAI to include advanced AI technology, it has benefited from the humanoid robot trend by enabling real-time learning and adaptation of robots. They are therefore adaptable to a variety of sectors, including industry and healthcare. Figure AI’s significant funding rounds demonstrate its commitment to innovation.

The company’s valuation increased to $2.6 billion after it recently raised $675 million. Prominent investors with a firm conviction in Figure AI’s potential include Microsoft, OpenAI, Nvidia, and Jeff Bezos. With such solid backing and modern technology, Figure AI is poised to revolutionize the robotics industry worldwide.

Figure AI Pre-IPO Trades

Transactions in the private market can be complicated and may include wire transfers to third parties, legal purchase agreements, and company clearances. Since trades can take anywhere from 30 to 60 days to complete, numerous investors seek the assistance of seasoned private market brokers to help them navigate the process.

Issuer clearance is required for direct share transfers. Issuers can steer the seller to a buyer of their choosing by using the right of first refusal. Transactions are prohibited by certain issuers. In these situations, buyers have the option to use forward purchase agreements or special purpose vehicles to acquire indirect interests in the company.

How to Buy Figure AI Stock?

Since Figure AI is privately held, purchasing its stock is complicated than purchasing shares of a publicly traded corporation. Just accredited and institutional investors may purchase its stock through designated methods because it is not listed on public markets.

Prior to its IPO, retail investors are unable to undertake direct investments in Figure AI. Yet, there are methods to participate. Figure AI stock is available to accredited investors through private market platforms such as Forge.

Another way to gain exposure to this exciting AI robotics firm is through indirect investment choices, such as venture funds that own shares in Figure AI.

Direct Acquisition from Stockholders

Accredited investors can buy Figure AI stock straight from existing shareholders, including angel investors, venture capital firms, and current or former workers. Opportunities for these direct purchases are provided by platforms such as Hiive.

Access to Figure AI’s complete ownership data may be limited by disclosure regulations for private businesses. When buying stock in a private company, accredited investors should conduct extensive due research to comprehend the risks and benefits.

Using Pre-IPO Marketplaces to Invest

Accredited investors can purchase Figure AI stock via pre-IPO marketplaces such as EquityZen and UpMarket. These platforms offer exposure to pre-IPO businesses such as Figure AI prior to its public debut by facilitating transactions with existing shareholders on secondary marketplaces.

In addition to providing liquidity alternatives prior to the IPO, these marketplaces enable investors to sell figure AI shares. Accredited investors and sellers are connected by platforms such as EquityZen, which establish a private firm stock trading marketplace and offer chances for those interested in high-growth companies such as Figure AI.

Options for Indirect Investments

Investing in venture funds that own shares in Figure AI is an optimal option for people who do not meet the requirements to become qualified investors or who would rather diversify.

As of September 2024, Figure AI owns 3.89% of the ARK Venture Fund, which provides exposure to a wider range of high-potential businesses while also providing indirect investment in Figure AI.

Another indirect investment option is the ability for institutional investors to trade private market stocks. There are plenty of options for prospective investors to consider because the demand for Figure AI shares is now lower than the supply.

Figure AI Stock Price and Valuation

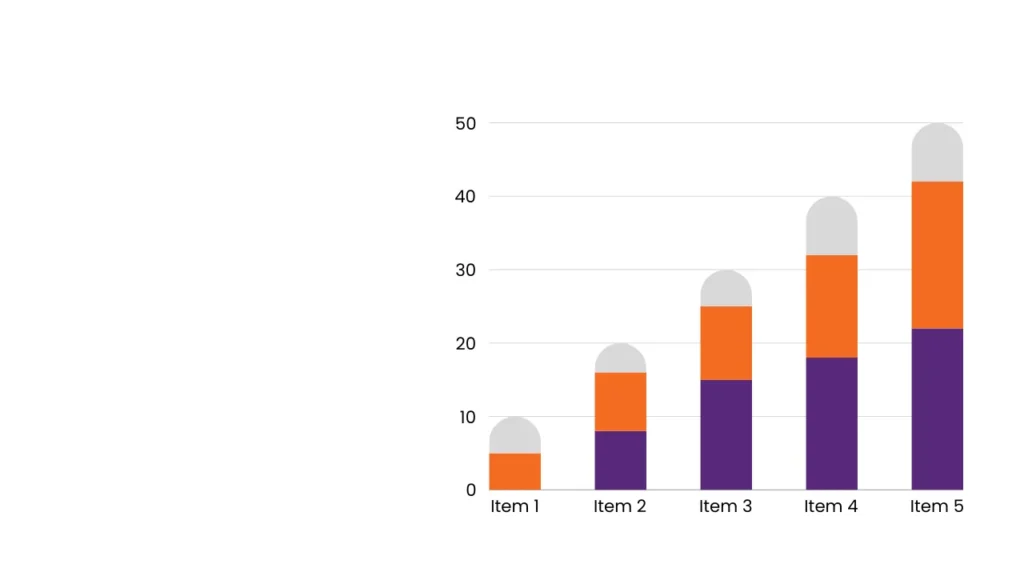

Comprehending for informed investing decisions, Figure AI’s stock price and valuation are key. The market’s faith in the company’s potential and its technology and business model innovations is reflected in its valuation, which jumped from $445.6 million in April 2023 to $2.6 billion in February 2024.

Divided by the number of outstanding shares, Figure AI’s estimated stock price is around $5.89. Investors use this as a standard by which to judge the possible return on their investment.

Current Valuation History

The valuation history of Figure AI demonstrates its quick expansion and high investor trust. Following a successful Series B investment round that raised $675 million from significant donors such as Microsoft, OpenAI, Nvidia, and Jeff Bezos, the company’s valuation reached $2.6 billion by February 2024.

From July 2023 to February 2024, the company’s worth increased by 550%, highlighting its advancements and market potential. Figure AI has also received assistance from prominent financiers such as Parkway, Nvidia, and Intel Capital, which has increased its legitimacy and financial stability.

This support from influential groups demonstrates faith in Figure AI’s mission and technological innovations.

Prospects for the Future and the IPO Schedule

With significant development potential and market opportunities, Figure AI appears to have a bright future. It is primed for long-term success because of its emphasis on fusing AI with physical robotics. Investors should be aware, though, that Figure AI’s public offering is probably years away.

Those interested in its IPO aspirations should stay informed through official business communications and trustworthy financial news sources.

Anticipated Expansion and Market Possibilities

At a compound annual growth rate (CAGR) of 50%, the humanoid robot industry is expected to increase from $1.53 billion in 2022 to $58.95 billion by 2031. Figure AI is positioned to benefit from this expansion because of its emphasis on flexible, learning robots.

Its developments in robotics and AI have the potential to transform labor-scarce industries, including manufacturing and logistics. The growing use of robotics in healthcare offers new investment opportunities outside of manufacturing and logistics.

Investors might investigate a number of options to increase productivity and generate substantial profits in the humanoid robot industry as the market expands. High development and adoption expenses, in addition to the requirement for technological advancements in mobility and battery life, are obstacles to commercialization.

Long-term business prospects in the humanoid robots’ industry are still significant in spite of these obstacles.

Timeline for the Anticipated IPO

Even with its encouraging progress, Figure AI is probably years away from going public. For updates on its IPO ambitions, investors should keep an eye on official communications and trustworthy financial news sources. A registered broker dealer could be required to buy Figure AI’s stock after it goes public.

Notable Partnerships and Associations

Figure AI has established key alliances to expand its business reach and innovation. Its partnership with OpenAI aims to incorporate advanced artificial intelligence into humanoid robots so they can learn and adapt in real time.

This collaboration has the potential to increase the use of humanoid robots in a number of sectors, such as healthcare and manufacturing. In addition, Figure AI uses Microsoft Azure for AI infrastructure, training, and storage, and has collaborated with BMW for robotics deployment.

These partnerships strengthen Figure AI’s innovative capabilities and position the company as a major force in the robotics and AI industries.

Investing in Similar Businesses

By purchasing stock in publicly traded firms that own Figure AI, investors can increase their exposure to the technology. There are several strategies to think about for investors wanting to become involved in the humanoid robots’ market:

- Investing money into publicly traded firms developing key enabling technologies or humanoid robots. This includes popular robotics manufacturers such as ABB and Fanuc, in addition to startups such as Tesla creating Optimus and Nvidia creating AI processors.

- Investigating robotics and AI-focused ETFs, which might offer extensive exposure to the industry. ROBO (ROBO Global Robotics and Automation Index ETF) and BOTZ (Global X Robotics & Artificial Intelligence ETF) are two examples.

- Investing money into businesses that provide key components for humanoid robots, such as sensors, actuators, and advanced materials.

Conclusion: How to Buy Figure AI Stock?

Investing in Figure AI offers a special chance to join an advanced AI robotics business with enormous growth potential.

Although accredited and institutional investors are currently the only ones able to undertake direct investments, there are other methods to become familiar with Figure AI, including through venture funds and pre-IPO marketplaces.

Taking wise investment decisions requires knowledge of the company’s valuation, stock price estimate, and prospects.

FAQs: How to Buy Figure AI Stock?

What is Figure AI and why should I consider buying Figure AI stock?

Figure AI is a company specializing in AI robotics and innovative technology solutions. Investing in Figure AI stock offers potential growth opportunities due to its advanced technology and market position.

As figure AI is a private company, it may provide unique investment opportunities that are not available with established, publicly traded companies. Consideration should be given to the company’s valuation and future prospects when deciding to invest in Figure AI.

How can I buy Figure AI stock?

To buy Figure AI stock, you need to wait until the company goes public through an IPO. Figure AI is a privately held company, meaning its shares are not available for public purchase. If you are an accredited investor, you may have opportunities to invest in Figure AI during funding rounds before the IPO.

What is an IPO and when is Figure AI’s IPO expected?

An IPO (Initial Public Offering) is the process through which a private company offers its shares to the public for the first time. This is an event for any company, and it enables investors to purchase shares on the open market.

As of now, the exact date of Figure AI’s IPO has not been publicly announced, but companies aim for this milestone when they feel confident in their valuation and market conditions.

What factors influence the stock price of Figure AI?

The stock price of a company such as Figure AI can be influenced by multiple factors including market demand, the company’s financial performance, economic conditions, and technological advancements in AI robotics.

Investor sentiment and media coverage can play significant roles in determining how the stock is valued once it becomes publicly traded.

Can I invest in Figure AI before its IPO?

Invest in Figure AI before its IPO if you qualify as an accredited investor. This often involves participating in a funding round where private shares are sold to a limited number of investors. Keep in mind that investing in Pre-IPO companies comes with higher risks and limited liquidity.