As a privately held business, Viz.AI is not now listed on any stock exchanges, such as the NASDAQ or NYSE. Since Viz.AI is not presently a publicly traded corporation, Viz.AI stock does not have an official ticker symbol.

Forge, one of the largest private market trading platforms, assists institutional investors in finding liquidity when they purchase and sell private shares for their clients or portfolios.

To avoid AI detection, use Undetectable AI. It can do it in a single click.

Table of Contents

Viz.AI

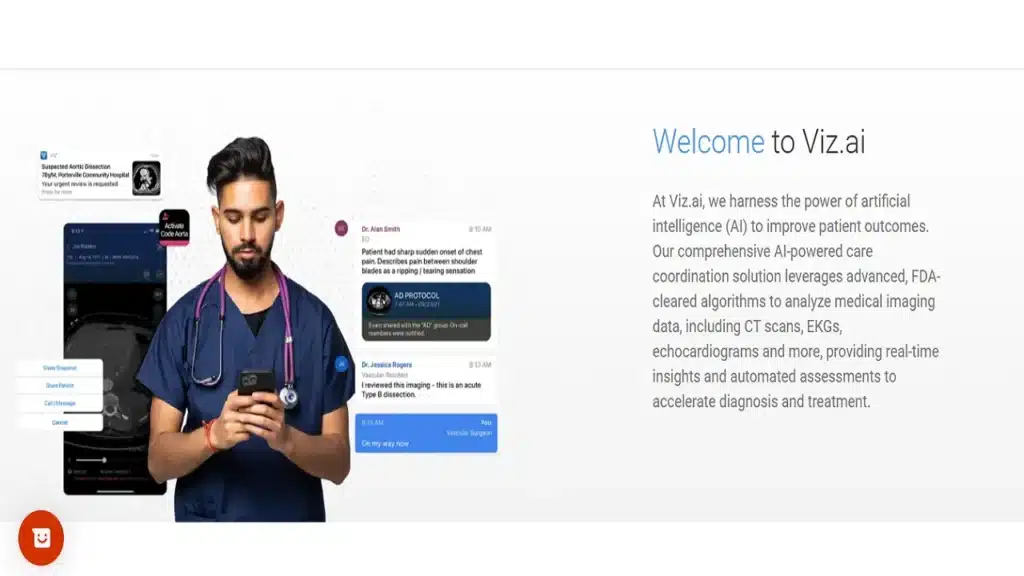

Viz.AI provides a platform for disease identification and care coordination driven by AI. The business is at the forefront of applying AI algorithms and machine learning to increase access to medicines that can save lives. Improving patient outcomes and getting rid of systemic delays are their goals.

Viz.AI’s modern technology bridges the boundaries between patients, doctors, and life-saving treatments, revolutionizing clinical workflow and patient care.

Their advanced driven by AI care coordination technology uses artificial intelligence to provide automated evaluations and real-time insights from a variety of medical imaging data, including echocardiograms, CT scans, and EKGs. Viz.AI speeds up diagnosis and treatment with advanced, FDA-approved algorithms to improve patient care.

Viz.AI Market

Shares of Viz.AI are available for purchase or sale, and there is secondary market activity. The current supply of shares exceeds then the demand from investors.

Viz.AI Valuation

The 2024 valuation of Viz.AI is unclear. The $40 million funding round that was raised in March 2023 did not reveal the valuation. The Viz.AI Funding valuation was determined by CIBC Innovation Banking, which also led the investment. In March 2022, the Series D $1.2 B valuation was established.

Viz.AI Revenue

Revenues from Viz.AI increased from $23.0 million in 2022 to an expected $40.0 million in 2023.

Viz.AI Funding

Tiger Global, Insight Partners, Kleiner Perkins, and Greenoaks Capital are among the prominent investors who have contributed a total of $293.4 million to Viz.AI over the course of seven rounds.

Viz.AI Investors

There are 13 investors in Viz.AI. Eight investment rounds for Viz.AI have been led by eight investors. CIBC Innovation Banking led the funding round. Other prominent investors in Viz.AI include Greenoaks Capital, Tiger Global, Insight Partners, and Kleiner Perkins.

Viz.AI Stock Price

By dividing the company’s valuation by the total number of outstanding shares, one can obtain the Viz.AI stock price. We do not know what number of shares are in circulation right now because a private corporation can issue new shares at any time.

Assuming, however, that Viz.AI has issued 250 million shares, each share of Viz.AI stock would be worth $4.77 at the estimated UpMarket valuation of $1.19 billion.

How to Buy Viz.AI Stock?

You have to be eligible to invest as an accredited investor in order to use Forge to participate in a private company such as Viz.AI.

- To use Forge’s marketplace, register for a free account.

- Show that you are interested in certain investments. You may find comprehensive price and financing details for thousands of private businesses in Forge Markets.

- A dedicated Forge Private Market Specialist can be on hand during this process to answer any queries you might have and to help you move smoothly through each stage of the transaction.

Not everyone can buy Viz.AI’s stock because it is not publicly traded. You need to be an accredited investor in order to purchase stock in private companies such as Viz.AI. You can sign up for Forge’s Secondary Marketplace to purchase private market stock if you fulfill the accreditation requirements.

How to Sell Viz.AI Stock?

Forge can assist you with selling any private company shares of Viz.AI that you may have, whether you were an early investor or an employee.

- Register for a free Forge account to obtain access to the marketplace and speak with a knowledgeable Private Market Specialist about any queries you may have.

- Use Forge platform to express interest in selling your Viz.AI.

- Collaborate with your committed Private Market Specialist, who can help you in navigating the entire process.

You have the option to sell your existing Viz.AI stock. Forge can assist you with selling your shares in a way that suits both your needs and the interests of the business. To start the process, register with Forge right now if you are searching for liquidity.

If you have any questions along the road, a dedicated Forge Private Market Specialist can be on hand to answer them.

How to Invest in Viz.AI?

Shares of private enterprises such as Viz.AI are available for acquisition by accredited investors. Notice Premier Brokers is a reliable resource for investors looking for supply and assistance with trading.

Viz.AI’s shares cannot be bought on public stock exchanges such as the NYSE or Nasdaq because it is privately held. Retail investors are not permitted to invest directly in Viz.AI prior to the initial public offering (IPO) or access this stock through conventional brokerage accounts.

Viz.AI Pre-IPO Trades

The choice to go public through an IPO is a complicated one that is influenced by a number of variables, such as the company’s financial performance, the state of the market, and its strategic objectives.

Any forecasts regarding when or whether Viz.AI would go public would be hypothetical until the company formally declares its desire to do so. For any updates on possible IPO plans, investors interested in Viz AI should keep an eye on official corporate communications and trustworthy financial news sources.

Accredited investors would normally buy shares from existing shareholders using specialist investment platforms such as UpMarket in pre-IPO sales for Viz.AI. Since trades take place on the secondary market, shares are privately swapped between two individuals rather than Viz.AI issuing new shares or receiving funds.

Although investors hope to gain money from a possible IPO or acquisition, these investments are risky because of the lack of information and liquidity. Since each transaction might include different terms and conditions, it is necessary to understand them. Investing in private businesses carries a high risk of substantial capital loss.

Conclusion: Viz.AI Stock

Since Viz.AI is a privately held business, its founders, management, staff, venture capital funds, and other private and institutional investors own shares in the company.

Since private and public firms are subject to different disclosure laws, it might not always be possible to determine the full ownership of a private company such as Viz.AI.

Since Viz.AI is a privately held business, its stock price is not publicly available. Nevertheless, you can use Forge Data to access the Viz.AI private market stock price.

FAQs: Viz.AI Stock

What is Viz.AI?

Viz.AI is a technology company focused on leveraging artificial intelligence to improve patient care within the healthcare sector. Founded in 2016, Viz.AI aims to enhance care coordination among healthcare providers by using AI-powered solutions in medical imaging and disease detection.

What is the current stock price of Viz.AI?

The Viz.AI stock price currently depends on its status as a privately held company. As of now, Viz.AI has not gone public, so there is no official stock price available for trading on stock exchanges. Investors interested in buying Viz.AI stock would need to wait until an IPO occurs or seek opportunities in the private market.

When is Viz.AI’s IPO expected?

While there has been speculation about a potential IPO for Viz.AI, the exact date remains uncertain. The company has conducted several funding rounds and is often evaluated based on its valuation in those rounds.

Investors should keep an eye on market news and company announcements for updates on the prospect of a public offering.

How can I invest in Viz.AI?

To invest in Viz.AI, potential investors may need to participate in private investment opportunities or wait for the company to go public. Currently, the options for buying or selling Viz.AI shares are limited to accredited investors who can access pre-IPO shares during funding rounds or other private financing events.

What is Viz.AI’s valuation?

The valuation of Viz.AI fluctuates with each funding round. The company has raised substantial capital, and its current post-money valuation reflects investor confidence in its AI-powered care coordination platform. Exact figures may vary, so it is advisable to check the latest reports or financial news for current estimates.